Let's look at the market internals for yesterday, they clearly showed some sign of weakness, and the market showed this weakness as well.

$NYAD- broken down again today the moving averages are close to crossing. The highs have gotten shorter and shorter since the rally has started.

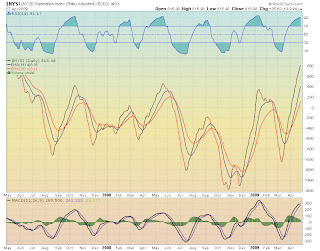

Here is the Cumulative $NYAD, you can see the nice trendline it has been in. A break of this trendline would be important for the market.

Looking at $NYMO it turned down yesterday. The moving averages are now starting to turn down. Shorter-Term moving averages such as the 9 or 5 EMA are moving down steeper then the 19 and 39 EMA's.

$NYSI- barely ticked up yesterday. It reflects what we saw in the $NYAD and $NYMO. Continued weakness of these two indicators will put pressure on the $NYSI.

Check out the cumulative $TICK chart. A more defined sell signal would be to see the TICK start a downtrend.

MEGA- One thing to note is that $SPXA50 was acutally up yesterday

MEGA B- Decliners and the down volume won yesterday.

Based on the futures this morning the market should test some key levels in the 840's today, if the bears can hold 850 it should put some additional weakness into the market.

Key things to watch today:

845 on the 60 min- means the up channel is brokem

854 weekly 20 EMA

838 Daily 50 EMA

840 Daily level is support.

Dollar is down, EUR/USD up, Oil down