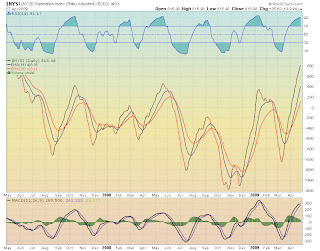

But even with $NYAD up, $NYMO moved down again today: But notice the MACD is making a move up on the histogram.

$NYSI- still moving up but the MACD has been steadily declining.

Here is one of my picks for the week and other stock I picked up:

NUS- The stock broke it's trendline earlier in the week, and was showing Bearish Divergence on the MACD I had my stopped set at 14.05 but made an executive decision to move it slightly above. It worked this time and I am still short this stock.

GEOY- is a good example of a stock breaking out of its bull flag in an uptrend. My target is 26 for this stock, it should be a 3 pt measured move.

The trend is still up in the this market and although the indicators look like they might be weakening, because of the trend the indicators can move right back up.