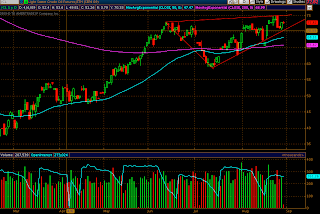

HEB is looking like a great play, it was up on some higher then average volume and bounced off support. This is also a Swine Flu play as these stocks have been ripping up. Just look at SVA today.

Here is another low risk trade, stop below 2.00. I am holding from 2.05. A break above 2.25 would also be bullish. HEB has no moved above it's 50 and 20 ema, and these are set to cross if the stock moves up more, MACD is firming up and is looking bullish.

A break above 2.35 would be bullish or a close above 2.25.

Monday, August 31, 2009

NCS

NCS was a low risk long today. I entered at 2.54, there is some support around 2.50. It makes for a nice low risk trade. Plus there is a gap that might get filled if it can break 2.75.

NYMO said sell

On Friday the $NYMO indicator crossed below zero giving a sell signal.

As of this morning the sell signal is correct, but the key will be if NYMO can stay below the zero line and decline further. Because it is so close to the zero line, it will be important to watch the Advancers and Declines today. Downward pressure will support NYMO going lower.

Also NYSI moved down yesterday:

Because of NYSI high levels, it will need a strong about of advancers to keep it at these levels. Watch again for the breadth in the market for clues for these indicators.

As of this morning the sell signal is correct, but the key will be if NYMO can stay below the zero line and decline further. Because it is so close to the zero line, it will be important to watch the Advancers and Declines today. Downward pressure will support NYMO going lower.

Also NYSI moved down yesterday:

Because of NYSI high levels, it will need a strong about of advancers to keep it at these levels. Watch again for the breadth in the market for clues for these indicators.

June Repeat?

SPX ended last week down a huge -2.05. This isn't representative of the large swings SPX had during the week. The tri-star pattern did not reveal did not give us a 4th day confirmation candle. This is why it is important with candlesticks patterns to wait for a confirmation day.

The price action the past couple of days was very similar to the price action in late June.

Look at the daily chart of SPX notice in June when SPX chopped around the 200EMA, eventually falling to the May lows. The price action last week was very similar, there was a lot of spikes to new highs but bears were able to control the upper levels. SPX in June ended in many dojis, we had very similar patterns last week.

The weekly chart shows the pattern much better. The doji last week was also followed by very low volume. Volume has been weak since early August.

KEY LEVELS:

The key levels to watch on SPX are 1016, on the daily chart this is a short-term trendline(greenline) and 1016 is the 200MA on the monthly chart. This level held last week and provided a strong bouncing point. If SPX can hold above 1036 it would be a victory for the bulls. Futures look to be opening up around 1020 so this level could provide a bounce at the open.

The June topping action started a multi-week decline, will it be the same this time?

The price action the past couple of days was very similar to the price action in late June.

Look at the daily chart of SPX notice in June when SPX chopped around the 200EMA, eventually falling to the May lows. The price action last week was very similar, there was a lot of spikes to new highs but bears were able to control the upper levels. SPX in June ended in many dojis, we had very similar patterns last week.

The weekly chart shows the pattern much better. The doji last week was also followed by very low volume. Volume has been weak since early August.

KEY LEVELS:

The key levels to watch on SPX are 1016, on the daily chart this is a short-term trendline(greenline) and 1016 is the 200MA on the monthly chart. This level held last week and provided a strong bouncing point. If SPX can hold above 1036 it would be a victory for the bulls. Futures look to be opening up around 1020 so this level could provide a bounce at the open.

The June topping action started a multi-week decline, will it be the same this time?

Friday, August 28, 2009

Oil and U.S Peso

Important support level for the dollar. It is at a possible bounce area, Short-term up trendline and HL support.

Oil Coming into the sweet spot of it's triangle,

I will be watching these two today, If around gets around 74-75 it may be a good short or if the dollar looks to be firming up.

Oil Coming into the sweet spot of it's triangle,

I will be watching these two today, If around gets around 74-75 it may be a good short or if the dollar looks to be firming up.

Wednesday, August 26, 2009

Tri Star and the Market Psychology and Market Sentiment

Right now SPX has formed a Tri-Star Reversal pattern.

The past three days SPX has closed almost at unchanged, forming three consectuive doji's which together formed a Tri-Star Reversal Pattern. The pattern is also accompanied by low volume during the last three days.

The pattern is rare, and is meant to signal a reversal of the current trend, of course with all candle stick patterns the fourth down should give confirmation of the candlestick pattern.

The Psychology Behind the Market

Candlesticks can show you the psychology of the traders, think about the psyche of trader during the last three days. The market reaches new highs, has good economic data, yet each day pulled back from those high's and finished almost unchanged. If you are bullish you are worried, if you are bearish you see resistance.

The long shadows of the three candles shows that sellers have been able to control the upper levels of the candles and that buyers are unsure to buy at these levels.

If buyers are unsure about buying at these levels, then any downward pressure could force them to sell quickly.

The last time SPX formed 3 doji's was on July 8th, 9th and 10th, and on the 13th, the market reversed to climb to new highs. This pattern was not a Tri-Star reversal but still signaled three days of indecision in the market after a trend down.

Here is a Tri-Star bullish reversal

The Market Sentiment

Think about July, the market was at it's critical support level of 880. Everyone was screaming HEAD AND SHOULDERS! there was a strong bearish sentiment around Wall st, then there is days of indecision and then the market rallies after GS had great "earnings".

The psychology and sentiment is similar now to what is was in July, but to the bullish side. The t Investor Intelligence Sentiment is well shifted to the Bullish side. This sentiment index was, well shifted to the bearish side in July.

Will the market play out like it did in July but to the opposite side, if SPX has a strong down day tomorrow it will confirm the Tri-Star reversal.

Tomorrow the market is stacked with economic data, could this be the straw that breaks the bulls back. Just have to wait and see.

The past three days SPX has closed almost at unchanged, forming three consectuive doji's which together formed a Tri-Star Reversal Pattern. The pattern is also accompanied by low volume during the last three days.

The pattern is rare, and is meant to signal a reversal of the current trend, of course with all candle stick patterns the fourth down should give confirmation of the candlestick pattern.

The Psychology Behind the Market

Candlesticks can show you the psychology of the traders, think about the psyche of trader during the last three days. The market reaches new highs, has good economic data, yet each day pulled back from those high's and finished almost unchanged. If you are bullish you are worried, if you are bearish you see resistance.

The long shadows of the three candles shows that sellers have been able to control the upper levels of the candles and that buyers are unsure to buy at these levels.

If buyers are unsure about buying at these levels, then any downward pressure could force them to sell quickly.

The last time SPX formed 3 doji's was on July 8th, 9th and 10th, and on the 13th, the market reversed to climb to new highs. This pattern was not a Tri-Star reversal but still signaled three days of indecision in the market after a trend down.

Here is a Tri-Star bullish reversal

The Market Sentiment

Think about July, the market was at it's critical support level of 880. Everyone was screaming HEAD AND SHOULDERS! there was a strong bearish sentiment around Wall st, then there is days of indecision and then the market rallies after GS had great "earnings".

The psychology and sentiment is similar now to what is was in July, but to the bullish side. The t Investor Intelligence Sentiment is well shifted to the Bullish side. This sentiment index was, well shifted to the bearish side in July.

Will the market play out like it did in July but to the opposite side, if SPX has a strong down day tomorrow it will confirm the Tri-Star reversal.

Tomorrow the market is stacked with economic data, could this be the straw that breaks the bulls back. Just have to wait and see.

Tuesday, August 25, 2009

Spot the divergence?

Here is the MEGA B chart, twice it has given a pullback signal each time the market ripped up, te down volume trend line gaped below the green line and closed above the green horizontal line. This signals a pullback may occur.

The pullbacks during this signal have still be very shallow, since the market is above its 200EMA

. The most important thing to take from this chart is the divergence between the $NYADV(advancers) and $NYUPV(Up volume). Notice how the market has advanced but the trend of these positive breadth indicators has been down.

The pullbacks during this signal have still be very shallow, since the market is above its 200EMA

. The most important thing to take from this chart is the divergence between the $NYADV(advancers) and $NYUPV(Up volume). Notice how the market has advanced but the trend of these positive breadth indicators has been down.

This is clear divergence in the market, if this move was a true move to new highs advancers and up-volume would be leading the way. If you look at the previous moves up, it was lead by a moving average that was trending up.

This doesn't mean the market will tank tomorrow but it shows that the latest move up has been without support of the internals.

Here is another chart that is showing divergence.

$NYHL is not making high's with the market, in fact it is trending down and the moving averages are trending down. If SPX is making new high's, so should other stocks but this is not the case

Between the two charts you can see how the first move the market made from 880-1000 was with strength, now the market's move seems to be lacking the internal strength that it had when it moved above 1000.

Also look at NYSI and NYMO, both had failed to make new high's with the market.

This doesn't mean the market will tank tomorrow but it shows that the latest move up has been without support of the internals.

Here is another chart that is showing divergence.

$NYHL is not making high's with the market, in fact it is trending down and the moving averages are trending down. If SPX is making new high's, so should other stocks but this is not the case

Between the two charts you can see how the first move the market made from 880-1000 was with strength, now the market's move seems to be lacking the internal strength that it had when it moved above 1000.

Also look at NYSI and NYMO, both had failed to make new high's with the market.

SPX Meeting Resistance

Twice so far SPX has failed at the top of its rising wedge. Think about the psychology of the past two days of action. The market reaches new highs and reverses it's course closing well below it's highs. If you are using the candle stick psychology then you have to assume the sellers were able to take control of the market and move it down from those highs.

There is longer-term resistance SPX is hitting, today it smacked against the bottom candles of the 2001 monthly.

The past market reversal have been started with the Energy sector. Right now Oil is right at resistance and has failed to get above it.

The dollar may be firming up and has hit the bottom of its new channel it formed and made a hammer today.

Also watch around 79 it would mean a break of it's down trend line.

There is longer-term resistance SPX is hitting, today it smacked against the bottom candles of the 2001 monthly.

The past market reversal have been started with the Energy sector. Right now Oil is right at resistance and has failed to get above it.

The dollar may be firming up and has hit the bottom of its new channel it formed and made a hammer today.

Also watch around 79 it would mean a break of it's down trend line.

Monday, August 24, 2009

TICK TICK TICK, no boom

TICK is an important indicator to watch it can tell you if the move up has legs. A strong move up should be associated with a strong tick and the opposite for a move down.

Here is a chart hourly of market breadth chart that I use MEGA B. It's a hourly version of my MEGA B chart that has been shown on here.

There was a big TICK spike on the 18th, which was a strong sign of the rally that occurred the last few days. But since then TICK has failed to make higher highs. Today as the market made higher highs, TICK just barely went above it's high spike on Friday. Using a 5 day EMA you can see that TICK has been trending down in a channel.

Intraday TICK was trending down after the market's highs at 11:00. TICK even hit -1000 showing good selling pressure.

Another indicator that the rally to the new high today would not have the steam to stay there was the breadth of the market. Looking at the Hourly Mega B chart you can see that advancers and upvolume was weaker then Friday's move. If the market is making new high's you want breadth to be behind it.

Here is a chart hourly of market breadth chart that I use MEGA B. It's a hourly version of my MEGA B chart that has been shown on here.

There was a big TICK spike on the 18th, which was a strong sign of the rally that occurred the last few days. But since then TICK has failed to make higher highs. Today as the market made higher highs, TICK just barely went above it's high spike on Friday. Using a 5 day EMA you can see that TICK has been trending down in a channel.

Intraday TICK was trending down after the market's highs at 11:00. TICK even hit -1000 showing good selling pressure.

Another indicator that the rally to the new high today would not have the steam to stay there was the breadth of the market. Looking at the Hourly Mega B chart you can see that advancers and upvolume was weaker then Friday's move. If the market is making new high's you want breadth to be behind it.

Thursday, August 20, 2009

Take my charts please

I will be on vacation till Sunday, here are some charts I follow which should update live/delayed depending if you have Stockcharts.

60 Min SPX

Daily SPX

$RIFIN 60 Min

$RIFIN daily

Seems like today is all about the numbers.

60 Min SPX

Daily SPX

$RIFIN 60 Min

$RIFIN daily

Seems like today is all about the numbers.

Economic

8:30am Initial Jobless Claims (last 558K), Continuing Claims (last 6.202M)

10:00am July Leading Indicators (last 0.7%), Aug Philadelphia Fed (last -7.5)

10:30am Natural Gas Inventories

11:00am Treasury note announcement

Levels to watch.

$RIFIN- break about 732 then a break above 750 would be huge based on the daily chart

$SPX- break above 1000

Wednesday, August 19, 2009

Playing the Warren Buffet Card today

What a shock the market looks like it is going to break it's support and they play the Warren Buffet card. They have done this before bring out Buffet to say it's safe to buy stocks. Well played, little early to play the Wild Card but it's your market. I personally think this run-up was on the news the Madoff has a small penis. It left many CEO's at Goldman Sachs feeling even more insecure with their even smaller penises, so instead of buying a sports car they gunned the market to make their PnL (so to speak) larger!

Today is a day when having stops works, I was out once SPX got above 21EMA. Leaving me out of the run-up.

Now SPX has run right against it's 1000 resistance level and short-term on the hourly is looking overbought.

Just as support has become resistance, the resistance is now support. So 990 is now support, but the more times the market touches that 980 level the weaker it becomes. The last two days the market has been up, both days SPX has seen low volume. While the market has rallied the last two days, it is still inside Monday's candle which still favors the bears.

Look at the NYAD line today, it spiked down while the market spiked up.

I exited the bear camp today around the 980's but re-entered around 998. Last time Mr. Buffet came out and told everyone it was safe to buy was Oct 17, the market tanked 2 days later.

Careful playing the Wild Card so early:

Today is a day when having stops works, I was out once SPX got above 21EMA. Leaving me out of the run-up.

Now SPX has run right against it's 1000 resistance level and short-term on the hourly is looking overbought.

Just as support has become resistance, the resistance is now support. So 990 is now support, but the more times the market touches that 980 level the weaker it becomes. The last two days the market has been up, both days SPX has seen low volume. While the market has rallied the last two days, it is still inside Monday's candle which still favors the bears.

Look at the NYAD line today, it spiked down while the market spiked up.

I exited the bear camp today around the 980's but re-entered around 998. Last time Mr. Buffet came out and told everyone it was safe to buy was Oct 17, the market tanked 2 days later.

Careful playing the Wild Card so early:

Internals of a weakening market

Yesterday's post I left you hanging on why I am in the bearish camp on the market. First is that the economy is not fixed. A a .01 uptick in unemployment "FIXED" and there are no green shoots.

To the charts now.

Here is a chart called MEGA B. It has all the breadth charts on it. If you look at the current trend of negative breadth (NYDNV and NYDEC), there is a new uptrend in this negative breadth. Both indicators have almost broken through their down trendline since the market has started it's run up in July. The last time $NYDEC broke it's downtrend line was in June after the market topped around it's 200EMA.

NYAD which has been mentioned a few times here recently has fallen below it's 8 day EMA. Notice the pattern that has occurred when the NYAD stays below it's 8EMA. If NYAD stays below its 8EMA it can start a pullback on SPX. So watch the internals today, if they are leaning towards negative side, NYAD should stay below its 8 day EMA. If they are really strong to the downside NYAD could break it's next EMA.

TICK- there is a divergence happening on with TICK. The market has been moving up but the strength of TICK has been falling. Here is a chart with the 2MA and 5MA, you can see the steady decline while the market has climbed.

NYMO-This indicator is still below zero which is bearish for the market. August 11th NYMO gave a sell signal and was confirmed on August 14th as NYMO made another move below zero. It also looks to be basing underneath the zero line, which is bearish.

While I am in the bear camp, I am ready to put out the camp fire if SPX can get at least an hourly close above 990 or the hourly SPX 21EMA, bottom line 990 was once support is now resistance.

Right now futures look to be right at support so it is very possible for a gap down and a fade up today, but be aware of a trend day.

To the charts now.

Here is a chart called MEGA B. It has all the breadth charts on it. If you look at the current trend of negative breadth (NYDNV and NYDEC), there is a new uptrend in this negative breadth. Both indicators have almost broken through their down trendline since the market has started it's run up in July. The last time $NYDEC broke it's downtrend line was in June after the market topped around it's 200EMA.

NYAD which has been mentioned a few times here recently has fallen below it's 8 day EMA. Notice the pattern that has occurred when the NYAD stays below it's 8EMA. If NYAD stays below its 8EMA it can start a pullback on SPX. So watch the internals today, if they are leaning towards negative side, NYAD should stay below its 8 day EMA. If they are really strong to the downside NYAD could break it's next EMA.

TICK- there is a divergence happening on with TICK. The market has been moving up but the strength of TICK has been falling. Here is a chart with the 2MA and 5MA, you can see the steady decline while the market has climbed.

NYMO-This indicator is still below zero which is bearish for the market. August 11th NYMO gave a sell signal and was confirmed on August 14th as NYMO made another move below zero. It also looks to be basing underneath the zero line, which is bearish.

While I am in the bear camp, I am ready to put out the camp fire if SPX can get at least an hourly close above 990 or the hourly SPX 21EMA, bottom line 990 was once support is now resistance.

Right now futures look to be right at support so it is very possible for a gap down and a fade up today, but be aware of a trend day.

Tuesday, August 18, 2009

Who passed the gas

UPDATE! OUT OF UNG -.01 Loss, did not like the trade

Natural Gas that is. I went long a low risk trade on Natty Gas, ticker UNG. If it can hold that new trendline, it may have a chance at 13.00, Stoch is starting to turn up and is oversold.

There is Hurricane Bill out in the Atlantic, but it may not even be a factor it's projected path is not towards the Gulf of Mexico. It should make for some nice surf on Long Island this weekend though.

Natural Gas that is. I went long a low risk trade on Natty Gas, ticker UNG. If it can hold that new trendline, it may have a chance at 13.00, Stoch is starting to turn up and is oversold.

There is Hurricane Bill out in the Atlantic, but it may not even be a factor it's projected path is not towards the Gulf of Mexico. It should make for some nice surf on Long Island this weekend though.

What was once support is now resistance

"A support level penetrated by a significant margin, becomes a resistance level and vice versa" (John Murphy, Technical Analysis of the Financial Markets)

990 once provide some strong support, seen on the daily chart below, but on Monday was broken "by a significant margin" this area is now providing some strong resistance for the market.

One thing that should concern some bears is how the STOCH has moved out of the overbought area and now has become netural. The market is only overbought on a weekly timeframe now.

The resistance at 990 can be seen better on the hourly chart. It failed to close above 990 which also was the 21EMA for the hourly chart on SPX.

SPX has entered another very tight range, untill either 990 is broken or 975 neither bulls or bears have control of the market. Although I am giving a slight edge to the bears, more on that to come. CLIFFHANGER!!!

990 once provide some strong support, seen on the daily chart below, but on Monday was broken "by a significant margin" this area is now providing some strong resistance for the market.

One thing that should concern some bears is how the STOCH has moved out of the overbought area and now has become netural. The market is only overbought on a weekly timeframe now.

The resistance at 990 can be seen better on the hourly chart. It failed to close above 990 which also was the 21EMA for the hourly chart on SPX.

SPX has entered another very tight range, untill either 990 is broken or 975 neither bulls or bears have control of the market. Although I am giving a slight edge to the bears, more on that to come. CLIFFHANGER!!!

So far just a "correction"

CNBC is sticking to their cheat sheet and calling this a correction, this is a snap shot from their website yesterday.

The market should bounce a little today, given historically the market has average at least 8 points after a .06 NYUPV:NYTV ratio. Putting the market at resistance around 990.

Short-Term the market is oversold. Looking at the hourly chart of SPX, the Stoch are pointing to oversold and there is a slight divergence in the MACD histogram, both nothing to get to excited about.

The bulls were able to defend the 980-970 area but the bears were able to get below the 20 ema on the daily chart. This acted as resistance throughout the day. Watch this level for resistance again.

The bears were able to do a lot of damage to the daily chart in a short amount of time. (Good work boys!). There is now significant overhead resistance from 990-1018. It also provides some clean stops for shorting. The key level I am watching for SPX is 970, it has a confluence of key support levels on different time frames.

Hourly:

973 200ema

Daily:

970- Bottom of August support

Weekly

968- 50ema

This will the first area to really watch for a bounce or even to set a stop if you want to play the long side.

Looking longer-term which should take precedent over short-term, depending on how you trade. The week just started but yesterday SPX dipped below it's downtrend line which it had broken out of it. This trendline may now act as resistance to the market.

Short-term:

Oversold, resistance above, historically should get a bounce.

Long-term:

Market overbought, indicators turning down but support around the 970 area.

The market should bounce a little today, given historically the market has average at least 8 points after a .06 NYUPV:NYTV ratio. Putting the market at resistance around 990.

Short-Term the market is oversold. Looking at the hourly chart of SPX, the Stoch are pointing to oversold and there is a slight divergence in the MACD histogram, both nothing to get to excited about.

The bulls were able to defend the 980-970 area but the bears were able to get below the 20 ema on the daily chart. This acted as resistance throughout the day. Watch this level for resistance again.

The bears were able to do a lot of damage to the daily chart in a short amount of time. (Good work boys!). There is now significant overhead resistance from 990-1018. It also provides some clean stops for shorting. The key level I am watching for SPX is 970, it has a confluence of key support levels on different time frames.

Hourly:

973 200ema

Daily:

970- Bottom of August support

Weekly

968- 50ema

This will the first area to really watch for a bounce or even to set a stop if you want to play the long side.

Looking longer-term which should take precedent over short-term, depending on how you trade. The week just started but yesterday SPX dipped below it's downtrend line which it had broken out of it. This trendline may now act as resistance to the market.

Short-term:

Oversold, resistance above, historically should get a bounce.

Long-term:

Market overbought, indicators turning down but support around the 970 area.

Monday, August 17, 2009

Up Volume Gone

The up volume to total volume or (NYUPV:NYTV) today was at .06 a very low number although not the lowest. This ratio has been .06 and lower only 31 times since 1997. All but 4 of these occurrences occurred in 07-09, most occurred in 2008 when the market had its most volatile time. With a VIX in the 70's

Here is a chart fshows today's dip in the lack of Up Volume. The NYUPV:NYTV is just a 1 EMA so you can see better when this ratio has hit .06 or lower.

On average the next day the SPX was up 8.38, but some of the biggest up days have been after the upvolume to total has registered a .06 or lower. SPX has rebounded 50 points after losing 50 points. More importantly is that this large one sided day in volume shows that volatility has moved back into the market. Most of these occurrences of such a high propotion of downside volume has occurred in the most volatile markets. Together with VIX breaking out today( as seen in this evenings post by BEAR), and the sign of a complete one-sided market today. The market could be signaling that more large moves can be on the horizon and a much more dangerous market. These moves can be both to the upside and to the downside so be careful on both sides if volatility comes back into the market.

Here is a chart fshows today's dip in the lack of Up Volume. The NYUPV:NYTV is just a 1 EMA so you can see better when this ratio has hit .06 or lower.

On average the next day the SPX was up 8.38, but some of the biggest up days have been after the upvolume to total has registered a .06 or lower. SPX has rebounded 50 points after losing 50 points. More importantly is that this large one sided day in volume shows that volatility has moved back into the market. Most of these occurrences of such a high propotion of downside volume has occurred in the most volatile markets. Together with VIX breaking out today( as seen in this evenings post by BEAR), and the sign of a complete one-sided market today. The market could be signaling that more large moves can be on the horizon and a much more dangerous market. These moves can be both to the upside and to the downside so be careful on both sides if volatility comes back into the market.

VIX and Other Side of the World

Everyone meet Bear AKA (Faceincabs). He will be guest posting from time to time. He has some great charts and a different way to look at the market.

Today he will be focusing on the VIX and Foreign Markets.

VIX

The $VIX showed some signs of life by spiking through some overhead resistance with big engulfing candlestick.

Focus on Foreign Markets

I mentioned multiple times in the past month over at Slope of Hope that I was closely watching currency shifts during the months of July and August as the topping process unfolded in the domestic markets. Here are a couple of charts related to my observations.

The first chart highlights the relationship between the Yen/Euro pair and the World Markets … it is clearly an inverse relationship. After Monday, it is easy to see that we finally have another flight to safety move developing in the Yen. Because of this, I am seeing an opportunity developing to short many foreign focused ETF’s (see list below) over the next few days and weeks, solely based on the charting landscape noted above. Technically, any rise by the Yen I generally consider beneficial to shorting the foreign ETF’s. A continued decrease in commodities may also help move this short trade move along.

A Trade Set Up

A viable short trade of the currently shared landscape of the foreign ETF’s (e.g., all of them gapped down today) is a chart pattern which Alan Farley calls a “Hole in the Wall”. It is described well here (so I am not going to repeat much detail about it).

The “Hole in the Wall” is based on a shock event (much like Monday’s tape). Notice that this particular gap-based set up pattern is structured as a bearish trade AFTER a bullish run up. It is denoted by the gap down (and the subsequent hole or window formed) on the chart. From my personal experience, fibonacci measurements placed within the “hole” often reveal critical post-shock price levels, low risk entry points, and even stop points. As an example, I rarely place a stop any higher than the top of the window.

I have provided a focus on China (FXI) as a chart example above. You will need to conduct your own research of the ETF which you choose – including measuring the gap area, drawing your own fib’s on intra-day charts, and selecting stop prices and entry. I am merely providing what I see as a viable trading idea. Finally, other ETF’s focused on world markets include IFN (India), EEM (emerging markets), EDC (3X leverage), EEB (BRIC focus), BRF (Brazil), and IDX (Indonesia).

Good luck with your trade!

Today he will be focusing on the VIX and Foreign Markets.

VIX

The $VIX showed some signs of life by spiking through some overhead resistance with big engulfing candlestick.

Focus on Foreign Markets

I mentioned multiple times in the past month over at Slope of Hope that I was closely watching currency shifts during the months of July and August as the topping process unfolded in the domestic markets. Here are a couple of charts related to my observations.

The first chart highlights the relationship between the Yen/Euro pair and the World Markets … it is clearly an inverse relationship. After Monday, it is easy to see that we finally have another flight to safety move developing in the Yen. Because of this, I am seeing an opportunity developing to short many foreign focused ETF’s (see list below) over the next few days and weeks, solely based on the charting landscape noted above. Technically, any rise by the Yen I generally consider beneficial to shorting the foreign ETF’s. A continued decrease in commodities may also help move this short trade move along.

A Trade Set Up

A viable short trade of the currently shared landscape of the foreign ETF’s (e.g., all of them gapped down today) is a chart pattern which Alan Farley calls a “Hole in the Wall”. It is described well here (so I am not going to repeat much detail about it).

From HARDRIGHTEDGE.COM(Great site if you haven't checked it out)

When planning new gapper trades, the Hole in the Wall should be your first stop. Edwards and Magee briefly mentioned them in their classic Technical Analysis of Stock Trends. In the section on trend theory, they discuss an Island Reversal's important second gap (the one that "completes" the Island). E/M refer to this move as a counter trend Breakaway gap although it doesn't follow the rules they themselves provide on the subject.

While the Hole can mimic a Breakaway gap, it also contains unique properties. The counter trend shock triggers predictable price movement the trader can exploit for quick swing long entries and short sales.

E/M identified gaps by their physical momentum properties and forecasting value. Breakaway, Continuation and Exhaustion gaps defined clear focal points of price action that were seen over and over again in dynamically trending issues. But beyond these few formations, the authors dismissed the balance of gapping throughout the market universe as having no forecasting value. This is simply not true.

While classic definitions were once adequate, their work on the subject now lacks depth for the active trader. And unfortunately, the current trade dogma asserts that everything there is to know about gaps has been written.

The forecasting value of gap behavior goes well beyond the E/M world. The study of Gap Echos alone yields tremendous new insight on entry and exit strategies. And characteristic gaps as significant as the Big Three have always existed for the trader to identify and use.

The “Hole in the Wall” is based on a shock event (much like Monday’s tape). Notice that this particular gap-based set up pattern is structured as a bearish trade AFTER a bullish run up. It is denoted by the gap down (and the subsequent hole or window formed) on the chart. From my personal experience, fibonacci measurements placed within the “hole” often reveal critical post-shock price levels, low risk entry points, and even stop points. As an example, I rarely place a stop any higher than the top of the window.

I have provided a focus on China (FXI) as a chart example above. You will need to conduct your own research of the ETF which you choose – including measuring the gap area, drawing your own fib’s on intra-day charts, and selecting stop prices and entry. I am merely providing what I see as a viable trading idea. Finally, other ETF’s focused on world markets include IFN (India), EEM (emerging markets), EDC (3X leverage), EEB (BRIC focus), BRF (Brazil), and IDX (Indonesia).

Good luck with your trade!

uh oh!

Futures look to opening down 2% down. It's choas in the CNBC studios! Check out ZeroHedge they were able to catch a great quote from Bernanke.

But the Futures seem to have settled around this area of 985-980.

SPX should open around it's 980 support level. The bears need to break through this to totally control this market.

The 980 is support on the hourly, it is very weak support on the daily.

On the daily chart SPX will open below its 995 support (monthly 200EMA). There is no some strong overhead resistance in the market and gives you clean outs if you are shorting. Resistance is at 992(if the market opens below it), 1000, and 1018.

If you look longer-term on SPX, if the market opens at these levels. It should open back inside its weekly downtrend line.

With the day starting like this, the internals I mentioned last night will look even worse if the market holds this current baisis to the downside. The key now for Da Bears is if they can take out 980. So keep your eyes open to see if there is dip buying.

Here are a few shorts I like:

SVVS- shot up like a rocket. Trendline broken. Actually up pre-market so be careful. Stop at 17.00

CSL (Overbought, MACD divergence, at Resistance) Really like this one

JWN (below 27)

But the Futures seem to have settled around this area of 985-980.

SPX should open around it's 980 support level. The bears need to break through this to totally control this market.

The 980 is support on the hourly, it is very weak support on the daily.

On the daily chart SPX will open below its 995 support (monthly 200EMA). There is no some strong overhead resistance in the market and gives you clean outs if you are shorting. Resistance is at 992(if the market opens below it), 1000, and 1018.

If you look longer-term on SPX, if the market opens at these levels. It should open back inside its weekly downtrend line.

With the day starting like this, the internals I mentioned last night will look even worse if the market holds this current baisis to the downside. The key now for Da Bears is if they can take out 980. So keep your eyes open to see if there is dip buying.

Here are a few shorts I like:

SVVS- shot up like a rocket. Trendline broken. Actually up pre-market so be careful. Stop at 17.00

CSL (Overbought, MACD divergence, at Resistance) Really like this one

JWN (below 27)

CNBC Cheat sheet for today

If market open down 2%+= Correction. Make sure you say we are out the recession and this is a normal correction

If market moves down 3%+= Market was very overbought, bring on Bull to say this is a great buying opportunity

If market moves down 4%+= This is short sellers fault, the uptick rule should come back and shorts should be ban

If market moves down 5%+= 12 Panel squawk, all bulls, all must say anything bullish and say "green shoots" 3 times.

If market moves down 6%+= Sacrifice Cramer to the public

If market moves up to only down 1%= Bulls have control of the market. Scream Bull and Buy

If market closes up: Pump market more and call GS and say THANK YOU.

Note: Make a big deal about every little uptick. Mention only good things and how the economy is recovered.

If market moves down 3%+= Market was very overbought, bring on Bull to say this is a great buying opportunity

If market moves down 4%+= This is short sellers fault, the uptick rule should come back and shorts should be ban

If market moves down 5%+= 12 Panel squawk, all bulls, all must say anything bullish and say "green shoots" 3 times.

If market moves down 6%+= Sacrifice Cramer to the public

If market moves up to only down 1%= Bulls have control of the market. Scream Bull and Buy

If market closes up: Pump market more and call GS and say THANK YOU.

Note: Make a big deal about every little uptick. Mention only good things and how the economy is recovered.

Sunday, August 16, 2009

Looking at SPX internals

Any chick can look hot with sunglasses but the true test is when she takes the sunglasses off.

Right now SPX is looking hot she has made a nice move up, everyone in the world is wanting to play tonsil hockey with her.

But the smart guy at the bar see's she has sunglasses on will wait till she takes them off because she could look like this.

A face only a mother could love!

The first indication the markets recent move up could show a Sarah Jessica Park behind the sunglasses $NYHL. This indicator was mentioned last week. It was showing that the latest move up was being done as stocks were not making new 52week highs. This week SPX made another move to test it's highs but NYHL keep moving lower.

NYMO- Tuesday NYMO gave a sell signal, which I noted here. The key to this signal was if NYMO can stay below the zero line. The next day the market moved up and NYMO got above it, but since NYMO has moved below the zero line. Also note the steady decline in NYMO while the market has been rising, this is showing bearish divergence. If NYMO can continue it's decline it would so negative breadth in the market.

NYAD- After blasting off like a rocket ship, it has since settled down and based around a key moving average. At the same time, SPX has also based around the same moving average. The blue lines shows what the market does when both the NYAD and SPX break below the key moving averages.

If the market has a negative day and decliners take control the market, both should drop below the moving averages.

NYSI- this indicator finally turned down, which is a longer-term indicator. The chart shows how the SPX reacts when NYSI turns down. Since this is a longer-term indicator its better to watch and see if it can start a strong move down.

I am holding SRS and SDS. I'm thinking when this chick takes those sunglasses off she will be:

Right now SPX is looking hot she has made a nice move up, everyone in the world is wanting to play tonsil hockey with her.

But the smart guy at the bar see's she has sunglasses on will wait till she takes them off because she could look like this.

A face only a mother could love!

The first indication the markets recent move up could show a Sarah Jessica Park behind the sunglasses $NYHL. This indicator was mentioned last week. It was showing that the latest move up was being done as stocks were not making new 52week highs. This week SPX made another move to test it's highs but NYHL keep moving lower.

NYMO- Tuesday NYMO gave a sell signal, which I noted here. The key to this signal was if NYMO can stay below the zero line. The next day the market moved up and NYMO got above it, but since NYMO has moved below the zero line. Also note the steady decline in NYMO while the market has been rising, this is showing bearish divergence. If NYMO can continue it's decline it would so negative breadth in the market.

NYAD- After blasting off like a rocket ship, it has since settled down and based around a key moving average. At the same time, SPX has also based around the same moving average. The blue lines shows what the market does when both the NYAD and SPX break below the key moving averages.

If the market has a negative day and decliners take control the market, both should drop below the moving averages.

NYSI- this indicator finally turned down, which is a longer-term indicator. The chart shows how the SPX reacts when NYSI turns down. Since this is a longer-term indicator its better to watch and see if it can start a strong move down.

I am holding SRS and SDS. I'm thinking when this chick takes those sunglasses off she will be:

Subscribe to:

Posts (Atom)